How to Get the Best and Safest Personal Loan?

Private loans are loans which can be borrowed to fulfill your private wants. A private mortgage is a mortgage you could get from a financial institution. The settlement will specify the repayments and the due dates. It’s essential to be certain that you pay the installments on time when you apply for a private mortgage. When you default, it may end in your shedding your property.

The compensation quantity will embrace each the principal quantity borrowed and any curiosity accrued, in line with the settlement. The stipulated quantity have to be repaid every month to the financial institution or house-building society from which you borrowed the cash. You’ll resolve the quantity of the mortgage you’ll be able to repay the mortgage. The lender might also decide the quantity.

There are two sorts private loans. There are two forms of private loans: one is a secured mortgage and the opposite is an unsecured mortgage. As safety for defaulting on the mortgage, a secured mortgage can be utilized to mortage any property. To recuperate his cash, the loaner can promote the property.

The non-public market is crowded with gamers. This has led to critical monetary issues available in the market as a result of sort of loans they provide.

This doesn’t imply folks ought to cease making use of for private loans. Earlier than you apply for a mortgage, ensure that the establishment is reliable and well-respected. When you’re not cautious, there are some questionable establishments available on the market which will try to seize your property.

For these with good credit score rankings, property possession or a enterprise, it’s attainable to get a money mortgage. You’ll be able to simply get personnel loans from monetary establishments which have good buyer relations and a clear credit score file.

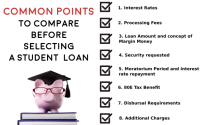

It’s attainable that you’re in dire want of a mortgage to cowl your rapid wants. You need to know what loans can be found to you earlier than making use of for a mortgage. A monetary advisor is a better option than making a choice. For private mortgages, it is best to evaluate gives from a number of lenders. If you do not have a monetary establishment or financial institution close by, it’s an choice to acquire loans on-line.

The market could be very aggressive for lenders. In any case you want a private mortgage, the establishment will be contacted. It’s simple to use for a mortgage. Private loans are normally unsecured. Borrowings are additionally restricted to fifteen,000 USD per individual.

It’s useful to have a great credit score file if you’re in want of a short-term mortgage. A money mortgage is the most suitable choice. There are three forms of money mortgage. There are two forms of money mortgage: money advance mortgage and deferred deposited mortgage. The kind of money mortgage chosen will decide the rate of interest.

When you select a professional private mortgage from a trusted establishment, you may get a private mortgage that meets your rapid wants.