Is It a Good Idea to Get a Personal Loan to Pay Off My Credit Card?

Many individuals are so deep in debt that we get many emails. We get requested the identical query time and again: “Ought to I get a private mortgage? It will assist us repay our bank card money owed?” Each state of affairs is exclusive.

This query is requested as a result of it is so easy. A bank card will cost you 20% per 12 months plus curiosity. Financial institution loans solely pay 10% per 12 months. Regardless that the distinction is just 10%, it could possibly make an enormous distinction in {dollars} over a 12 months. It could additionally imply that you’ll be able to pay down debt a lot sooner. It appears easy sufficient, however there are numerous shades to the query.

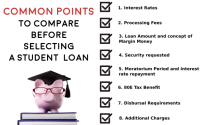

There are some questions that that you must ask. For those who reply every query YES, you must think about getting a private mortgage to repay your bank card.

1. Can I cancel my bank cards after they’re paid off? The cardboard firm will not cancel your bank cards simply because you’ve gotten paid off all of them. This have to be requested. That is one thing we have now seen up to now. They used the cardboard as if it have been their very own cash. Now quick ahead one 12 months. Now they’ve a few of their unique private mortgage debt, and their bank cards are in the identical place as after they took out the mortgage. After the stability is paid off, you have to be ready cancel your bank card 100%.

2. 2. Are you proud of your own home price range?

Do you wrestle to make ends meet month after month? Can you use bank cards to make up for the distinction? Many individuals suppose {that a} private mortgage will resolve their budgeting points. They get a private mortgage to repay their bank cards. Then they comply with our recommendation and shut their bank cards. Then tragedy strikes and their fridge bursts. They have no cash as a result of they reside pay examine to pay cheque. They rapidly say “I am doing one thing silly” after which return to any bank card firm to be authorized for a brand new card to cowl their fridge. They could be on the outlets, taking on an interest-free provide on a fridge. Do a little analysis earlier than you apply for a private mortgage. You’ll be able to check out just a few situations. What would you do in case you needed to pay $1000, $2000, or $3000 in a rush? You possibly can cowl the fee with out opening one other bank card.

3. Have you ever acquired a debit card?

You’ll need your bank card quantity for sure funds. Bank cards can typically be used to pay for purchases revamped the cellphone or on-line. You’ll be able to have all the advantages of a bank card, however your debit card enables you to pay with your individual cash. There is no such thing as a curiosity. Just remember to have a debit card arrange earlier than closing your bank card. Maintain a listing of all computerized direct debits that you’ve arrange. These corporations might be reached simply by cellphone to request that your month-to-month computerized debits be modified to your debit card. Late charges can lead to your bank card being shut down by corporations making an attempt to withdraw funds.

4. Are you allowed to make extra funds in your private loans with out being penalised?

Bank cards could be a lifesaver in your funds, however they do have one benefit. You do not have to pay the minimal quantity. Nonetheless, you possibly can nonetheless be penalized financially in case you exceed that quantity. For those who owe $20,000 and have paid $18,000, there aren’t any penalties. Private loans aren’t all the time so easy. You will have two choices for private loans: fastened curiosity or variable curiosity.

Variable curiosity lets you make extra funds with no penalty (or a small price relying on which financial institution). Mounted curiosity signifies that you comply with pay a set quantity of curiosity for the time period of the mortgage. You’ll be able to repay a 5-year fixed-interest mortgage in six months, however you may nonetheless be charged the complete five-year curiosity.

A variable curiosity mortgage is strongly really helpful. The most important advantage of a variable curiosity mortgage is that you would be able to pay more cash to cut back the time period of the mortgage and the quantity of curiosity you must pay. We’re positive you wish to eliminate debt in case you’re studying this. You’ll even be prepared to contribute any extra cash. You’ll have more cash to repay the private mortgage as your price range will get more healthy. It isn’t a good suggestion to manage to pay for to repay the private mortgage in full.

5. 5. Is it an excessive amount of to repay in six months?

For those who owe $20,000 to your bank card and have $500 in your checking account, and reside paycheck to paycheck, you’ll doubtless must repay your complete debt inside six months. For those who solely owe a small quantity that you would be able to pay again in six months, and you’ve got rigorously thought-about your price range, we advocate you to eliminate the private mortgage. Private loans would require you to pay an upfront price, a month-to-month price, and typically, a number of calls or journeys to the financial institution. These prices are sometimes dearer than the advantages of incomes curiosity on an quantity that you’re near repaying. That is the time to eliminate your card.

6. Have you ever thought-about a bank card stability switch possibility? ***(Very dangerous possibility. Solely think about this feature in case your )*** self-discipline is 100%.

If you’ll be able to look again at factors 1 and a couple of, and may reply a FIRMYES on each of those factors, then why not contact different stability switch corporations and see what they will do for you. Chances are you’ll be provided a zero curiosity stability as much as one 12 months by some bank card corporations. With a zero curiosity stability, you can also make as many funds of your alternative.

Listed here are some ideas on a stability switch and a private mortgage.

1. A private mortgage just isn’t the identical as money. You’ll be able to’t spend it if you have not used it to repay your bank card debt. You can even get into bother by transferring your stability. When you have $20,000 in bank card debt, your new card could have a restrict of $25,000 for it. Bank card corporations know the right way to get you to proceed spending cash and increase debt. It’s straightforward to fall again into outdated methods. You possibly can simply fall again into outdated habits, particularly contemplating the 0% rate of interest. You’ll be able to’t spend an extra cent on the cardboard when you repay this stability.

2. Bank card corporations need you to pay them as little every month as potential. Opposite to a financial institution mortgage, the place you possibly can resolve how lengthy it takes you to repay the mortgage (e.g. One 12 months to seven years. For those who do not pay the complete quantity, bank cards might be saved with you till you die. Bank card corporations could take as little as 2% of your complete stability to make a month-to-month fee.

Let’s check out $20,000 and evaluate it with a bank card at 20% curiosity to a private mortgage for 4 years @ 4.4% curiosity.

When you have a bank card stability of $20,000 over a 12 months, you may be FORCED TO PAY $4713

A private mortgage stability of $20,000 over a 12 months would lead to you being FORCED TO PAY

$6087

When you have a $20,000 bank card stability over 4 years, you may be FORCED TO PAY $17,770. This quantity would scale back the stability to $17 037.

For a $20,000 private mortgage stability over 4 years, you’ll be FORCED TO PAY

$24,348 (This quantity pays the stability to zero).

You’ll be able to see {that a} private mortgage will pressure you to place your cash in direction of your debt. A bank card encourages you to contribute as little as potential. Many individuals lack the self-discipline to pay greater than the minimal quantity of debt. To have the ability to do that, that you must have the power and self-discipline to stay along with your weapons.

3. What occurs after the 12-month zero interest-free interval ends?

What rate of interest would you obtain at this level? Is the curiosity charged again on any debt that continues to be after the date of the unique begin? What’s the annual price for this service? Is there a price for transferring a stability to a different card/firm? These are the inquiries to ask earlier than you switch your cash on a stability. If you are going to be charged ridiculous curiosity after the honeymoon, it’s not price doing a stability switch. Earlier than you do something, you will need to pay attention to all the main points. It’s a good suggestion to switch your stability to a brand new card with zero curiosity after the honeymoon interval ends.

Stability transfers might be very dangerous if you do not have it but. These are usually not choices we advocate. This path just isn’t with out its pitfalls. Don’t take this feature in case you are not sure of your talents. You’ll be able to return to non-public loans.

7. Are you not sure in case your annual price might be refunded?

This query is not going to have an effect on your ultimate choice on whether or not or not you apply for a private mortgage. Some card corporations will refund the annual price in case you pay $100 in January in your bank card. Though the price is just $50, it provides up. This price have to be requested. My expertise has proven that some bank card corporations have a foul behavior of not sending you a examine routinely. It could be price asking the query.

Closing conclusion: There are lots of shades to this query. It is very important do your analysis and discover the perfect resolution for you. These seven questions will enable you to reply the query “Sure” and make the precise choice. If you do not have all the things so as, please do not do a stability switch. I might advise that for each individual it fits, there are at the very least 20 who would not.

My title is Adam Goulding, and my story may be very easy. My financial institution stability was so low that I could not afford lease 4 years in the past. March 15, 2005 was the date I reached all-time low financially and emotionally. It is easy to sum all of it by saying that I’m utterly broke and in debt. This was resulting from a “she’ll be proper” perspective.

I used to be struck by a flashing mild and realized that this thought was so easy but it surely was a profound realization. All the things that occurred to my cash life up till March fifteenth 2005 was not working. My cash choices have been a large number. I had one realization that modified my life. Who might assist me get out of monetary bother? It was unimaginable to vary because the state of affairs would solely worsen over time.

Renee, my girlfriend (now my spouse), let me know her methodology for rising cash. Renee knew much more about cash than I did so she was capable of assist. Secret primary was to maintain more cash in my financial institution accounts, she advised me. This was the KISS precept. KISS stands for “Maintain It Easy, Silly”.

My guide “How one can scale back your debt to zero in 5 easy steps” is now out there.