NRI Low Rate Loan – Easy Way to Overcome Your Financial Problems

As it is normal said that “The companion in need is companion to be sure”, this precept is the most appropriate for loans. Truly, the loans are your dearest companions when you are battling with terrible monetary circumstances. There is compelling reason need to stress to borrowers since today there are a few banks accessible in the market that come to help you and give various sorts of loans. There are a few sorts of loans, for example, home loans, instruction loans, business loans, obligation union loans, vehicle endlessly loans for NRIs that make your various dreams valid. In this following article we will examine about the NRI loans.

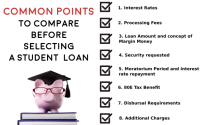

Any Non Private Indian who is battling with a terrible monetary circumstances, a unique loan is hanging tight for him. Along these lines, don’t bother stressing if you are a NRI and need to finish your different monetary necessities. Assuming that you have the fantasy to get advanced education which is exorbitant and you have absence of cash, you can get loan without any problem. Your fantasy about buying area to build home or you need to buy a loft to reside, home loans would help you. Alongside this, your fantasy to lay out your own business can be satisfied with the assistance of business loans. The NRI loans are very simple to profit, you simply have to introduce a few essential records like your substantial Indian visa. A vital condition is that a NRI who needs to get these loans ought to be an alumni and the age of the borrower ought to be no less than 21 years. The standard of the hold bank of India expresses that to profit the loan just those NRIs are qualified which have their own property in India. There are a few banks in India that proposition loans for NRIs, a portion of the rumored names are SBI, citi Money, ICICI bank, etc. These banks give different loans effectively and inside a limited capacity to focus time. The banks give the loans at various pace of revenue, in light of the fact that the rate relies upon the limit of the borrower to reimburse the loan. One can reimburse the loan in a few EMIs which is more simple than pay the whole sum in one time.

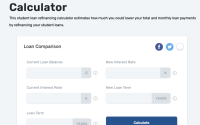

The data about these NRI low rate loans can be gathered on the web. These loans are accessible under both gotten and unstable classes. If you have any desire to get the NRI loans, at first you really want to pay the handling charge. This expense needs to pay when you will give the application for the loan and this handling charge is non-refundable. After that you will be required an eye to eye meeting and every one of your records will be confirm by the approved individual and afterward the loan will be given to you. In the event that you don’t pay the loan inside the concluded time you should pay the late installment charges.