Opt For Student Loan Consolidation and Solve Your Student Loan Problems

Understudies who have made loans just to complete their school review are presently hoping to track down ways of repaying their loans. Understudy loan solidification is being presented in reply to the issues understudies are looking in the wake of graduating in school by means of educational loans. Since most find it hard to search for a lucrative work after graduation, they are struggling with paying for their loan or loans so far as that is concerned. For the people who have more than one loan, then, at that point, you really want to merge school loans. This is your choice to try not to mount up of neglected loans while you are dealing with brief or low paying position.

What is understudy loan solidification? For understudies who want to concoct finances more than whatever one loan organization could offer get numerous loans from a few organizations. Come paying time, there will be isolated and individual bills coming from the organizations where they got the loan. In situations where the alumni can’t get a new line of work an immediately, there is a need to merge school loans. When you unite your loan, rather than paying silly month to month contribution, which is assessed to reach $300 up to $1000 you can lessen it to at least $100 each month.

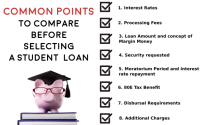

Understudy loan solidification is your definitive answer for the understudy loans issue while you are on an expert quest for new employment. As there are heaps of organizations offering private understudy loan combination you should simply find one that offers the least financing cost. What’s more, you want to look at on the organization, which offers a quick and fast cycle so you really want not invest a lot of energy on the handling, rather than using it to look for gainful employment. You can without much of a stretch chase after an organization that offers direct loan combination. You can now unite school loans without agonizing over it consistently and day, while being compelled on your pursuit of employment.

One thing you want to consider while picking an understudy loan combination is that you can take one loan solidification. When you neglect to get a new line of work to pay for the extraordinary loan, you should utilize one more choice of paying your ongoing understudy loan. One choice many have utilized in the patience, just to have a transitory break on an understudy loan issue. Before you select which private understudy loan combination organization you ought to pick, make an intensive examination first. Know your choice and compute the amount you will probably pay for your united understudy loans by utilizing the reimbursement mini-computer on the web.

One great maneuver is additionally to converse with the different organizations that proposal to unite private understudy loans. They know better and could guide you and show the various choices open for you. Ease up your concerns on educational loans by selecting understudy loan combination and sit back and relax while you track down the right and lucrative work subsequent to really buckling down all through your school life.