Small Business Loan Update – Is Anyone Out There Making Loans? Will the Federal Bailout Help Us?

As Americans, we are stuck to the most recent CNN, Fox, or nearby news announcing the advancements in Washington as to rescue programs. On the off chance that you are an entrepreneur, you are sitting tight for your bailout- – some uplifting news about opening up capital business sectors so you can apply for a humble private venture loan. In the midst of this dreary news, you may be enticed to inquire: “Could you at any point hear me? Is there anybody out there actually making business loans? There are such moneylenders, yet they are getting less continuously.

To comprehend the issue, you need to get a grip on how SBA banks work. In the times of our folks and grandparents, banks would make a loan in light of their liquidity originating from bank stores. They kept the loans in house and gathered the interest. You didn’t need to remain conscious in that frame of mind to sort out one can make a predetermined number of loans- – how much interest you are gathering is little in relationship to the complete chief loaned. You could make a $100,000 loan, however just get $10,000 back during the year on interest. At one point you just hit rock bottom financially to loan.

Yet, that all different over the most recent quite a few years when banks had the option to quickly sell their loans on the auxiliary market and get cash. So the equivalent $100,000 loan could promptly be sold for, speculatively, $110,000 (the expanded worth or premium comes from the way that the buyer would get revenue over the term of loan well in abundance of the chief loaned) and the bank would get new monies back into their money chests. So they re-tooled, started up the machines, and began putting out an ever increasing number of loans. The more they sold on the auxiliary market, the more benefit and further loans could be made.

SBA loans were especially appealing. Financial backers slobbered over those children. The National government promises them from default at the pace of somewhere in the range of half and 90%, contingent on the program used. So the banks would pool together and bundle their loans, selling on the optional market. Whoopee! Thus, financial backers would get them practically like a security. It was a success – win circumstance for everybody. Consequently, the auxiliary market was exceptionally vigorous for such loans.

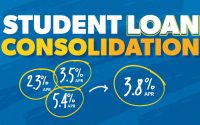

Yet, there was a drawback. SBA loans depend on a story rate (4.5% for Local area Express loans with long term terms) in addition to the Money Road Diary prime rate. Thus, for instance, the ongoing prime rate is 3.25% and when added to the floor rate yields an all out level of 7.5%. Yet, the great rate continues onward down. Accordingly, premium turns out to be endlessly lower and along these lines less appealing to financial backers (“less spread”).

Also, more awful yet, the quantity of SBA loans is diminishing. For instance, in August and September of 2008, SBA loans were down around half from the prior year.

Subsequently, the auxiliary market has evaporated. As indicated by James Hughes, President and Chief of Solidarity Bancorp, there’s practically no market left for SBA loans. See Pullback in Auxiliary Market Hits SBA Loan specialists (October 30, 2008). This implies that the bigger banks are utilizing solely contributor’s monies and corporate obligation to handle their loans.

So what is an independent venture to do? Here are a few ideas:

o Pick a SBA authorized loan specialist that is certainly not a huge bank. Keep in mind, banks are the conventional organizations that have checking and bank accounts, Mastercards, Album’s and such. In this market, barely any of them are making private company loans. Then again, non-vault SBA moneylenders are significantly more liable to loan.

o Find a moneylender that has had numerous long periods of involvement in private venture loans. They are significantly more prone to be private venture well disposed.

o Pick a bank that sits idle however SBA independent company loans. Since this is their main approach to bringing in cash, they must choose the option to keep loaning, even in a terrible market.

Fortunately Congress will ideally reestablish the conversation of animating the optional market to empower independent company loans. I’m not expressing this as a wide looked at romantic, but rather from the straightforward explanation that capital channels can’t be stopped up endlessly in our country. Indeed, even our lawmakers can’t wreck that straightforward reality of free enterprise. At the point when this occurs, the cash will again stream. I solidly accept this will occur, it is just an issue of when. In the following article I will talk about what monetary organizations could in any case make business loans.